The Seed Accelerator Rankings Project released their 2015 list of the Top 20 Startup Accelerators based in the US. A few days after the release, the research team’s co-director, Susan Lee Cohen, tweeted a link to this MIT Press Journal paper. Entitled: ‘What Accelerators Do? Insights From Incubators and Angels,’ I found it to be an insightful and comprehensive definition of accelerators, incubators and angel investors.

Did you know that accelerators and angel investors have more in common to each other than they appear to be? These, among other insights were very well explained in Cohen’s paper. I added my own input and formatted parts of her work to dig deeper in the misunderstood definitions, pros and cons, and comparisons between the three entities.

To cover the depth of this topic, I will divide this blog series into two parts. Part one is to define accelerators versus incubators and part two will be about angel investors. The following are the most important points to distinguish between accelerators and incubators, deriving from Cohen’s paper and my own input.

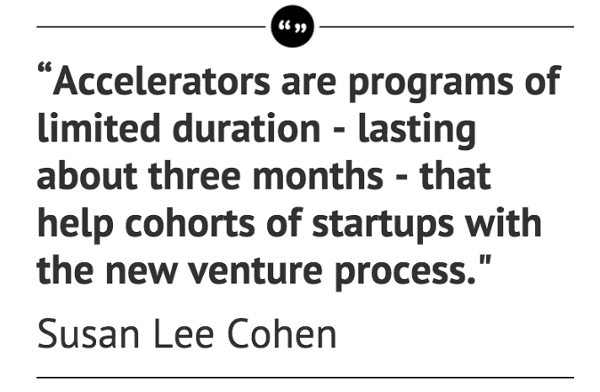

Accelerators help ventures define and build their initial products, identify promising customer segments, and secure resources, including capital and employees.

These are the characteristics of accelerators. They usually provide the following:

-

A small amount of seed capital

-

Working space

-

Networking with both peer ventures and mentors (who might be successful entrepreneurs, program graduates, venture capitalists, angel investors, or even corporate executives).

Here at JFDI Asia, an example is our very own Accelerate Program. The seed capital or initial cash investment amount we grant is up to SGD $25,000. The office we offer is in Blk71, Singapore’s so-called ‘startup building,’ a coworking space in Ayer Rajah industrial estate. It currently houses hundreds of tech-related organisations, including other start-ups, venture funds and incubators. The result of that is easy access to other like-minded industry experts hanging out in the area. Additionally, we offer intensive mentoring and introductions to more than 100 active early-stage investors. Today, JFDI operates the longest running and most successful Seed Accelerator program in Southeast Asia.

Our 2014B teams at Demo Day in Singapore.

Finally, most accelerator programs ends with a grand event, “Demo Day” where ventures pitch to a large audience of qualified investors.

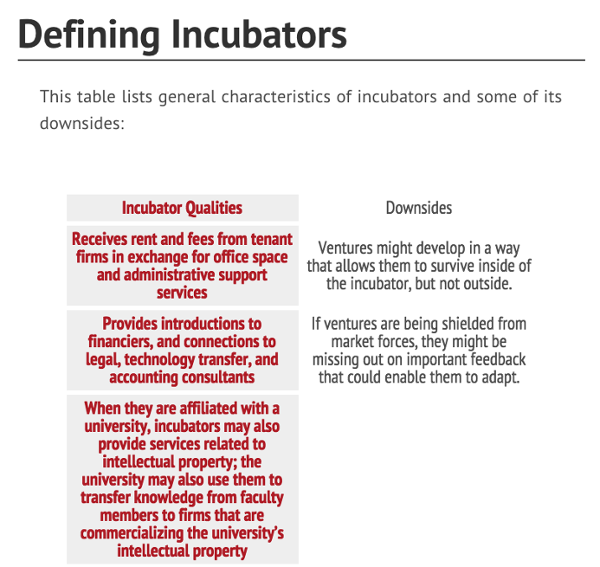

93% of all incubators are nonprofit organizations focused on economic development, and roughly a third are affiliated with a university.

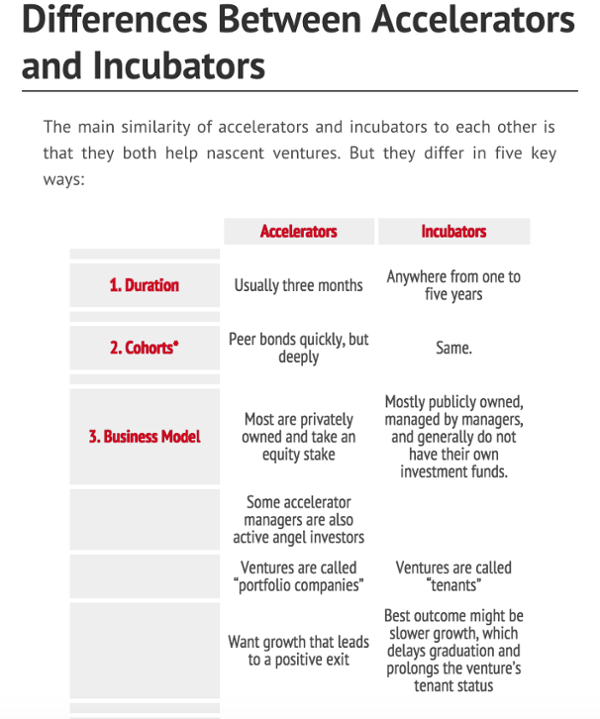

Now, how do you decide which one fits your startup needs? What’s better – an accelerator or incubator? I made this infographic to highlight the five key differences between the two.

*As a by-product of structured, limited-duration program, ventures enter and exit the programs in groups, known as cohorts.

Summary

Accelerators have obvious advantages over incubators. Here are six reasons why:

Advantage #1: The limited duration of accelerators, usually three months, restrict codependency.

Participating in an accelerator program may not necessarily keep the venture alive, instead it speeds up the ventures cycle – leading to quicker growth or quicker failure. This is not a bad thing — relocating all those valuable resources will benefit other high-value opportunities.

Advantage #2: There are two other benefits to the limited duration: (a) It focuses the founder’s attention; and (b) mentors are able to control their time.

Advantage #3: Ventures in accelerators are called “portfolio companies” while incubators call them “tenants.”

This is a key point. The incentives of accelerator directors who are investors in the firms they are helping are more closely aligned with the ventures than professional incubator managers.

Advantage #4: Accelerator owners, who are usually investors in the venture themselves have extensive prior experience they need to assist ventures with a myriad of tasks.

Advantage #5: Incubator tenants rarely take full advantage of available advice because mentorship is usually offered for a fee by service providers.

On the other hand, intensive mentorship and education are cornerstones of accelerator programs and often a primary reason to participate.

Advantage #6: Incubators tend to nurture nventures by buffering them from the environment to give them room to grow.

In contrast, accelerators speed up market interactions in order to help nascent ventures adapt quickly and learn.

Stay tuned for the next part of the series, where we dig deeper into angel investors, and how they have much more in common to accelerators than incubators.

Editor’s Note: This is part 1 of two-part series on defining accelerators and incubators. For Part 2, check it out here.

–––

Sources: This post heavily cites Susan Lee Cohen’s MIT Press Journal paper, ‘What Accelerators Do? Insights From Incubators and Angels,’. Graphics from infog.ram.

Crystal Superal is the Social Media and Content Marketer at JFDI, the #1 business accelerator in Asia. She finished her Multimedia Communications degree while playing golf for a San Francisco-based art school. She currently lives in Cebu City, Philippines. For her thoughts about tech and lifehacks, follow her Twitter @crystalsuperal.

Crystal Superal is the Social Media and Content Marketer at JFDI, the #1 business accelerator in Asia. She finished her Multimedia Communications degree while playing golf for a San Francisco-based art school. She currently lives in Cebu City, Philippines. For her thoughts about tech and lifehacks, follow her Twitter @crystalsuperal.