In Part 1 of this series, we discussed definitions of accelerators and incubators. Now, we’re going to talk about angel investors. I used to imagine angel investors as wealthy men dressed in dark suits. Did you know that sometimes, friends and family could become angel investors too? With additions of my few insights, this article heavily cites Susan Cohen’s paper, ‘What Accelerators Do? Insights From Incubators and Angels.’

Photo credit: Lending Memo

What is Angel Investor?

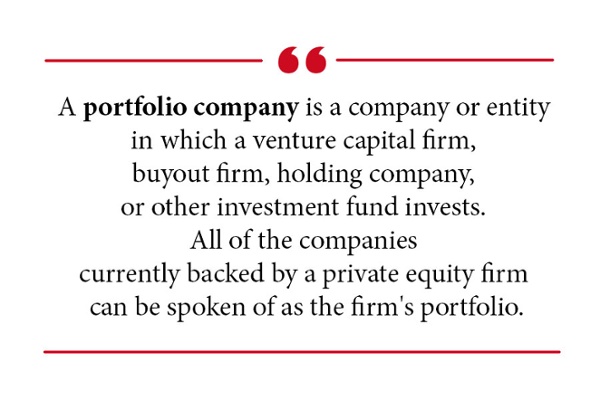

Angel Investors, usually individual investors, or groups of individual investors, also aim to help fledgling ventures. They provide seed capital and varying amounts of advice to young firms.

According to Center for Venture Research, 28,590 entrepreneurial ventures received $9.7 billion in investment during the first quarter of 2013. Clearly, angel investors are an important part of the entrepreneurial ecosystem.

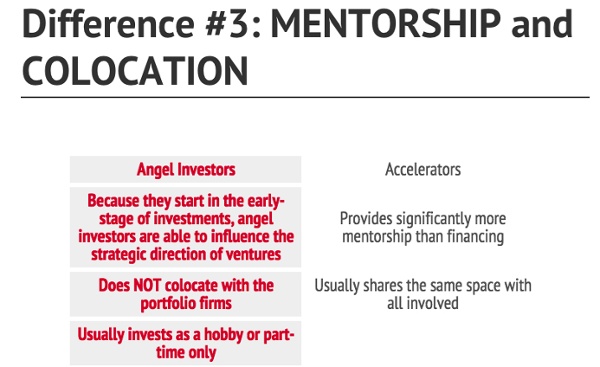

Often, but not always, they entrepreneurs who want to help the next generation of entrepreneurs. This leads us to one of its biggest disadvantages – limited education and mentorship. Angel investors help their portfolio firms in an unstructured manner, often providing advice and introductions in a need-only basis. Therefore the lack of structure means limited guidance.

Similarities Between Angel Investors and Accelerators

First, accelerators and angel investors are similar in the way that they both call ventures as portfolio firms. Here at JFDI Asia, we have been operating the longest-running, most successful seed accelerator program in South East Asia. Our portfolio firms include TradeGecko, Healint, Qwikwire, and more.

Second, since both accelerators and angels investors tend to be investors in the ventures themselves, incentives are aligned with those of founders. AsYevgeny Ioffe said in his Edtech Times article: “Their investments are usually diluted dramatically in subsequent rounds of funding, and are completely wiped out if the startup fails.” With such big risk, angel investors typically ask for extremely high rate of return to compensate.

Differences Between Angel Investors and Accelerators

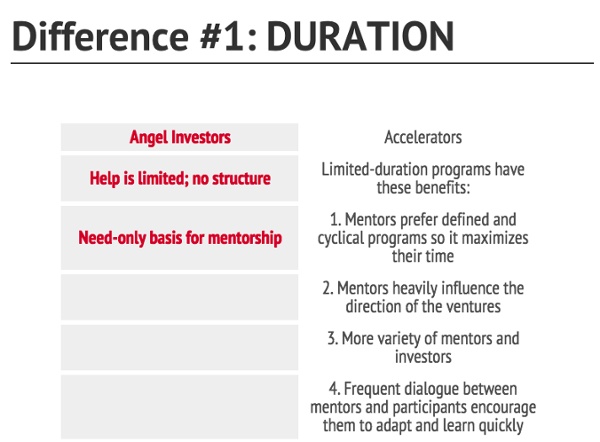

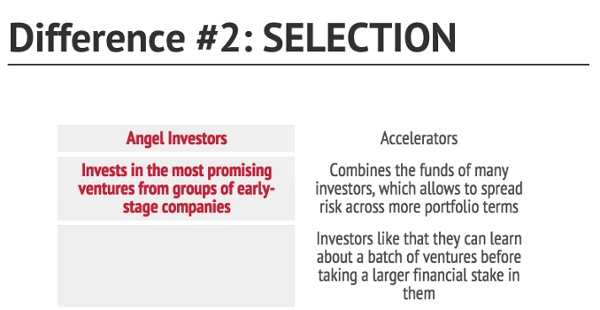

Now we will tackle the three major differences between accelerators and angel investors, namely: (1) Duration, (2) Selection, and (3) Mentorship and Colocation:

Summary:

Accelerators are a new type of organization that differs from angel investors and incubators. Certain components are the same, but generally,accelerators provide more advice than money. Its unique feature is being a limited-duration program, ending in Demo Day (when ventures get to pitch to qualified investors). As Startupowl summarizes, “accelerators are more hands-on and intense, making use of a kind of boot camp approach to venture creation.”

A photo from JFDI’s 2014B Demo Day

Speaking of accelerations, applications for our next program are now open. JFDI.Asia is Asia’s #1 Startup Accelerator. Our mentors, founders and investors form the perfect ecosystem for your startup to succeed in Asia. More than 60% of our Accelerate startups receive seed funding.

Crystal Neri writes content and handles social media at JFDI Asia, loves to workout and cook and dreams of vagabonding (someday). Say Hi to her on Twitter, @nericrystal.

Crystal Neri writes content and handles social media at JFDI Asia, loves to workout and cook and dreams of vagabonding (someday). Say Hi to her on Twitter, @nericrystal.